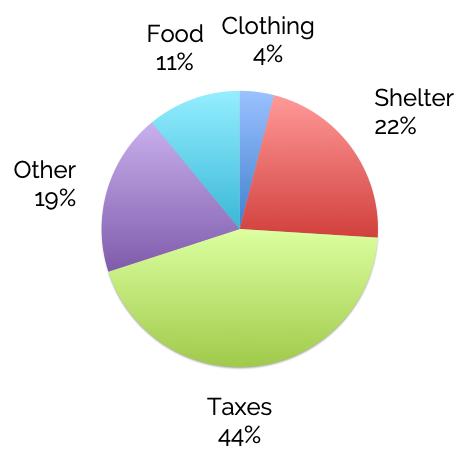

Ugh. Taxes.

Nobody likes paying taxes, they are an unfortunate fact of life. While sitting back and paying the bill that comes due each year is a typical approach for many Canadians, it often leaves money on the table that could have stayed in your pocket. Tax planning allows us to structure your investments into the right vehicles considering your tax bracket and marginal tax rate with the goal of minimizing your tax burden.